Bookkeeping is the recording of financial transactions and is part of the process of accounting in business. Bookkeepers are responsible for recording and classifying accounting transactions of a business.

Bookkeeping is important in business accounting because it allows you to see where your business is spending money, where your revenue is coming from, and most importantly, which tax deductions you will be able to claim.

In this blog post, we are going to provide a beginner’s guide to bookkeeping. We will start with the basics: understanding assets, liabilities, and equity, and plenty more. After that, we will provide you with what is called the accounting equation, which forms the foundation of your bookkeeping and ultimately your business.

Next, we will briefly cover the difference between single-entry and double-entry bookkeeping. Finally, we will suggest and summarize some tools to help you get started with bookkeeping. Let’s dive in.

The Basics

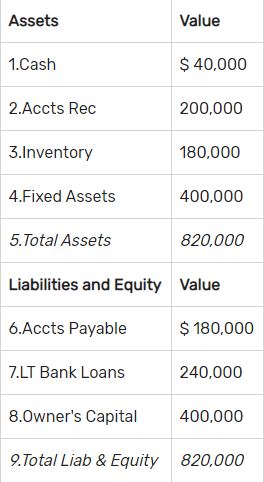

Understanding the basics to bookkeeping will help you step into the right direction of running your business. So, what exactly are the basics? Well, for beginners, there are assets, liabilities, and equity. These three components form your balance sheet. It’s okay if you do not know what this means. That’s why we are here. Let’s take a closer look at what assets, liabilities, and equity are.

- Assets: are cash, products, or services that your company owns. The can be from inventory to accounts receivables.

- Liabilities: are things that your company owes. So this could be, what you owe to suppliers (accounts payable, loans, mortgages, etc.

- Equity is the ownership a business owner and investor has in the business.

These three components are what form the accounting equation and what will become important for you in understanding the basics of bookkeeping. Don’t worry, we will explain how this all works later in the blog post. For now, let’s continue with some other basics that are good to know.

- Accounts Receivable: in basic definition, accounts receivable is money owed to a company by its debtors. So, if your company sells products or services and doesn’t collect payment immediately, you have “receivables,” or money that is due from customers.

- Inventory: is the unsold product. It is essentially money sitting on a shelf, but inventory is one of the most crucial assets that must be accounted for.

- Fixed Assets: Fixed assets include any equipment, vehicles, land, or building that you own. These assets are usually large and highly valued.

- Accounts Payable: is money that the company owes to suppliers, service providers, etc. These are usually the services/suppliers that help the business run.

- Retained earnings: track any company profits that are reinvested in the business and are not paid out to the owners. This is crucial to track to see how your company is performing over a period of time.

Okay, so now that we got the basics definitions out of the way, I am sure you are wondering what does all this even mean, or how does this apply to me? These terms are what balance the books. From assets to retained earnings, everything must be accounted for. Below is an image of what a simple balance sheet would look like, with the applied terms.

So, knowing what balances the books, the remaining question is, how? The answer: the accounting equation.

The Accounting Equation

The basic accounting formula: Assets= Liabilities + Shareholders’ Equity

This equation must balance because everything the business owns (assets) has been purchased with some form of debt (liability) or shareholders’ capital (equity). So let’s give an example of how this looks like.

If a business has $20,000 in liabilities, $40,000 in assets, and $20,000 in shareholders’ equity the accounting formula would read:

Liabilities ($20,000) = Assets ($40,000) – Shareholders’ Equity ($20,000)

Shareholders’ Equity ($20,000) = Assets ($40,000) – Liabilities ($20,000)

Assets ($40,000)= Liabilities ($20,000) + Shareholders’ Equity ($20,000)

If you know any two of the three components of the accounting equation, you can calculate the third component. To know if your books have balanced, remember that you compare your liabilities and equity to assets. As seen by the third equation, it balances.

Let’s dive a little deeper and give a transaction demonstration. Understanding how a transaction works will help you better understand the accounting formula. Understanding the accounting formula will help you learn how to balance your books.

How Transactions Work in Bookkeeping

So, when you start a new company, everything is zero. Remember your accounting formula: Assets = Liabilities + Shareholders.

0 = 0 + 0

Now, let’s say as the owner you want to deposit some money. You, as the owner, deposit $1,000. To make this easier, we are going to go with the double-entry bookkeeping system.

So, remember, if an owner has put money into his/her business (investing), then this is called equity. Remember, also, that assets are products, services, and cash that the company owns. By investing $1,000 into the company (equity), the company simultaneously now has an asset of $1,000. So, lets put this into the accounting equation.

Assets = Liabilities + Shareholders’ Equity.

$1,000 = 0 + $1,000

To help your business run, you purchase a $700 laptop on your business credit account. This is seen as a liability (money that we owe) because the $700 is on a credit account. So, let’s head back to our equation.

Assets = Liabilities + Shareholders’s Equity.

$1,700 = $700 + $1,000

An asset or liability account is created for each type of asset. The asset account (and total assets) for office equipment was increased by $700 and the liability account for the company’s credit card was increased by $700.

Think of this as a checks and balance system. So, now that you have everything you need to balance your books, let’s talk about which forms of bookkeeping are right for you.

Single-Entry vs. Double-Entry Bookkeeping

Bookkeeping is what makes your business survive. A business also survives on the person’s ability to establish good accounting practices. This is where deciding if single-entry or double-entry bookkeeping works best for you. Spoiler alert: everyone uses double-entry. But, what would we be if we didn’t at least mention single-entry bookkeeping?

- Single-Entry Bookkeeping:

- Works if your business is super small

- Similar to keeping a personal checkbook

- One entry is made for each transaction

- Does not track inventory, accounts payable, and accounts receivable

- Does not work in developing a balance sheet

- Double-Entry Bookkeeping:

- Each account has two columns and each transaction is located in two accounts

- Two entries made per transaction- debit and credit

- Used for paying off a creditor

- Keep track of asset and liability accounts

- Accurately calculate profit and loss

An example of how double-entry bookkeeping works can be seen from “The BalanceSmall Business,”

“An example of a double-entry transaction would be if the company wants to pay off a creditor. The cash account would be reduced by the amount the company owes the creditor. That would be the debit. Then, the double-entry reduces the amount the business now owes to the creditor account as it has received the amount of the credit the business is extending. That is the credit.”

BalanceSmall Business, 2019

Ideally, double-entry bookkeeping is the better solution. You can track more and accurately calculate the profit and loss of your business. If your business is extremely small, then perhaps, single-entry bookkeeping may be the better option. Finally, let’s look at some tools that can help with your bookkeeping.

Accounting Software

After studying the latest accounting software, we have come up with four tools that we believe may help with bookkeeping. Note, we are not accounting experts, and have made this list solely off of review, research, and case studies. We have not tried any of these tools ourselves.

Quickbooks: is very popular for accounting software. Quickbooks focuses on helping small businesses simplify and do their books.

Xero: is a QuickBooks alternative. Xero manages invoices, bank reconciliations, and bookkeeping.

Sage: Accounting software, or bookkeeping software, automates, organizes, and integrates typical financial transactions, helping a business run more smoothly every day

Kashoo: Mobile and online accounting software for small business that provides a cloud-based system for invoicing, expense tracking & bookkeeping.